|  Wine and spirits importers who are up in arms against

the Maharashtra government's order to levy excise duty of

150% on wines and 200% on spirits have approached the excise

commissioner to request him to follow the earlier system

of special duty per bottle. Meanwhile, the business is at

standstill causing inconvenience to consumers and losses

to the trade.

Wine and spirits importers who are up in arms against

the Maharashtra government's order to levy excise duty of

150% on wines and 200% on spirits have approached the excise

commissioner to request him to follow the earlier system

of special duty per bottle. Meanwhile, the business is at

standstill causing inconvenience to consumers and losses

to the trade.

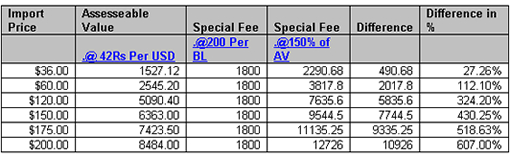

Whereas earlier a flat duty of Rs.200

bulk liter was charged on imported wines (translating into

Rs.1800 per case of 12 bottles of .750 litres) the latest

ruling implies a whopping 150% on the assessed value of

the bottle which is calculated at the CIF value +1%. The

following table explains the impact of the new policy on

a per case basis and the percentage basis. All the amounts

are in INR .

Let us take the example of a Brunello which

could have been costing $200 per case. Earlier the special

duty was Rs. 150 a bottle. This would translate into Rs.

1060. Now, there is an addition of Rs. 910 per bottle. Add

to this, the increase of basic duty from 100%to 150%. And

do not forget the VAT of 20% on the whole amount and you

are sure to get into depression-even if you are not an ardent

love of Brunello, an Italian gift to wine lovers throughout

the world from Tuscany.

The above differential will translate into

the end price being affected even more in the case of spirits

which attract a Special Fee of 200% of the Assessable Value.

The importers’ request is to continue

with a flat system of Special Fee per bulk litre as was

prevailing before. Speaking privately to delWine on conditions

of anonymity, most of them have expressed their willingness

to go with higher amounts per bulk liter (this might

adversely affect cheaper wines though-editor).

Biggest to be affected directly and immediately

are the hotels that have been paying no customs duty and

so an increase of customs duty does not affect them accept

reducing their entitlement-an indirect effect. ‘ With

most of the brands in the Wine Menu being priced prohibitively

compared to international standards, guests would stay away

from consuming wines and spirits, very badly affecting the

revenue of Hotels and Restaurants’, claim the petitioners.

‘ International Travelers, who constitute

bulk of the guests staying in five star hotels, would harbour

an impression, based on the Wine Menu prices, that Mumbai

hotels are very pricey, which is highly detrimental to the

interest of the State in general, and the Tourism Industry

in particular’ , adds the representation.

Another issue taken up by the importers

is the Assessment value. In the case of Indian manufacturers,

the cost of manufacture is taken as the assessment value.

Whereas in the case of imports, the landed value is deemed

to be taken as the benchmark, which includes the producer’s

profits and all the variable costs of transportation and

insurance etc.

The issue of MRP (max. retail price) and

imposition of Rs.2.5 lakhs of additional charge for importers

of imported goods to get the license endorsements are the

other sore points that ought to be resolved. Otherwise the

additional costs will have to be passed on to the consumer,

thus resulting in fatalistic losses in sales and profits.

While the legality of the notification

in terms of assessment value being unfair may be a matter

of debate and challenged in the courts later, if bigwigs

decide to take such action, the course of action taken by

the government does seem to be high handed and unfair.

Championing the cause of wine lovers,

delWine fully supports the representation made by the importers

with the hope that the officials keep the interest of the

consumer at heart too. Budgets and revenues are a matter

of prime concern but you also do not kill the goose that

lays the golden eggs, as it were-editor.

|